Álvaro García

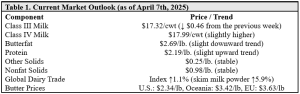

Rapid fluctuations in dairy prices can significantly impact producers’ profitability, making timely market analysis indispensable. The latest Dairy Outlook report (April 7th, 2025), authored by Dr. Normand St-Pierre, provides critical insights into current and upcoming trends in dairy markets, product pricing, and their implications for dairy producers. Dairy producers considering milk contracting should closely evaluate the futures market data presented in the recent Dairy Outlook report. The current six-month average for Class III milk futures is $17.32/cwt, reflecting a decrease of $0.46 from the previous week’s average. In contrast, the Class IV milk futures price stands slightly higher at $17.99/cwt, suggesting potentially more favorable returns for producers who target butterfat-rich milk.

Accurately predicting income becomes easier when evaluating the implied milk component prices derived from these futures markets:

- Butterfat averages around $2.69/lb., though it is currently trending slightly downward.

- Protein prices are expected to average approximately $2.19/lb., with a slight upward momentum observed.

- Other solids and nonfat solids’ prices remain relatively stable at about $0.25/lb. and $0.98/lb., respectively.

Role and impact of Global Dairy Trade (GDT)

International dairy market conditions are equally essential for U.S. producers to consider, as these trends significantly influence domestic pricing through export opportunities and international competition. The Global Dairy Trade (GDT) is an international online auction platform where major dairy-producing countries trade dairy commodities. Prices established in these auctions become benchmarks for global dairy markets. An increase in the GDT index typically signals higher global demand or constrained supplies, presenting opportunities for increased U.S. dairy exports and higher domestic prices. Conversely, a decline in the GDT index may reflect oversupply or weakening global demand, potentially pressuring U.S. prices downward due to heightened global competition.

In recent weeks, the GDT index rose by 1.1%, driven primarily by substantial increases in skim milk powder prices (+5.9%). Additionally, global butter prices remain notably higher ($3.42/lb. in Oceania and $3.63/lb. in the European Union) compared to U.S. butter prices ($2.34/lb.), creating favorable conditions for U.S. producers and cooperatives looking to capitalize on export opportunities.

Recommendations for milk contracting decisions

Recent USDA data points to a downward trend in domestic dairy product prices. Class III milk prices dropped from $20.18/cwt in February to $18.62/cwt in March 2025, a substantial decline. Dairy producers must consider these market dynamics carefully when deciding on future milk contracts. Although Class III prices remain somewhat within historical ranges, current futures suggest Class IV milk might offer comparatively better short-term returns.

Consider the following strategic recommendations based on current market conditions:

- Optimize milk composition: Producers capable of influencing milk composition through diet adjustments could aim to enhance butterfat content, thus aligning their product more closely with currently higher prices for Class IV milk. Practical steps might include optimizing fiber sources or incorporating byproducts known to positively affect milk fat production.

- Monitor protein market closely: While Class III milk prices show some volatility, observing upward shifts in protein prices can be beneficial for producers with milk rich in protein, allowing timely and advantageous contracting decisions. Improving milk protein can be achieved by increasing the supply of rumen-undegradable protein and balancing amino acids—especially methionine and lysine—in the cow’s diet.

- Focus on export opportunities: Producers involved or interested in export markets should regularly monitor international dairy price trends, especially for butter and skim milk powder, to benefit from price differences effectively and secure profitable contracts.

- Be aware of global risks: Despite domestic stability in certain dairy sectors, global trade dynamics remain uncertain. Producers must remain alert to sudden international tariff changes or geopolitical events, especially concerning major importing countries like Mexico, which could quickly alter market conditions and export profitability.

While the current outlook offers several optimistic insights, dairy producers should remain cautious about potential market risks, including sudden global price volatility, trade disruptions, or unexpected production shifts abroad. By utilizing information presented in the latest Dairy Outlook, producers can strategically manage milk contracting to their advantage. Aligning production strategies, whether emphasizing butterfat or protein content, and closely monitoring global and domestic dairy market conditions, will allow producers to effectively manage risks and enhance profitability in today’s volatile dairy market environment.

References

St-Pierre, N. (2025). Dairy Outlook Report (April 7, 2025). Weekly Dairy Outlook Newsletter, The Ohio State University.

S. Department of Agriculture, Economic Research Service (2025). Dairy Data.

Global Dairy Trade (2025). GDT Price Index.

© 2025 Dellait Knowledge Center. All Rights Reserved.